January 2022 Market & Mortgage Report

———–

Each Executive Summary Report is for a specific TRREB zone combination and includes a map of the included zones and a 4 page summary for each property type (detached, semi-detached, townhomes, condos)

The Information / statistics you can find in each Executive Summary Report include:

- Data comparing the – 1, 3, 5 and 10 year sales averages.

- Stats categories – Sales, New Listings, Active Listings, Average Price, Months of Inventory (MOI), Sales to New Listing Ratio (SNLR)

This Month’s Report

In this month’s edition of The Monthly Outline we cover the following topics:

- In the News & Timely Topics – Tax time and mortgages, housing supply shortage, and what’s next from the Bank of Canada.

- Our In Depth Stats Reports

- Current Mortgage Rates & Trends

Tax Time and Mortgages – A Critical Combination

T4s, T4As, T1s, T5s, Taxes, Taxes, Taxes! With income tax filing season upon us, it is a critical time to review how your tax filing may impact your purchasing power (or refinancing options) in 2022.

What follows are some key considerations for self-employed individuals or employees/contractors that earned variable income such as bonuses, commissions, or overtime during 2021.

The “2-Year Average Rule”

To determine a client’s borrowing power, most lenders will calculate income based on a 2-year average of the two most recent personal tax filings (or the most recent year only if lower). For example, if a client was approved in the fall of 2021, the lender would have used the average of the client’s 2019 and 2020 income to qualify. Now that 2021 is behind us, it is a great time to connect with your mortgage advisor to determine how your 2021 income may impact your borrowing power (increase or decrease) and any new mortgage options or strategies that may be available.

Self-Employed – Income Tax Filing Impact

Talk to your accountant and mortgage advisor BEFORE you file your 2021 income taxes. Most self-employed individuals have some flexibility with respect to expenses claimed within their corporation and how much income they decide to distribute to themselves through salary, dividend, corporate strip, etc. When it come to buying a home (or refinancing), these decisions are critical as they can have a direct impact on your mortgage approval amount. As there is no one size fits all solution, we regularly work in collaboration with a clients’ accountant to determine the most advantageous way forward. With direct access to over 30 banks, credit unions and other lenders, we can provide solutions that offer a great balance among tax efficiencies, a great rate, and maximum purchasing power.

Employees or Contractors with Variable Compensation

If you earned commission, received a bonus, work hourly, or received overtime pay, now is a great time to revisit your mortgage pre-approval to ensure everything is still in line when you are making an offer to purchase. Now that 2021 T4s and T4As are available, lenders will include the 2021 income to determine your approved mortgage amount. Given the impact of COVID, your 2020 income may have been an outlier year which could have skewed your borrowing power. If 2021 earnings are higher, we can now work with your 2021 and 2020 average (potentially even a 3-year average if 2020 was a blip year) in order to increase your borrowing power. If your 2021 income was lower than 2020, we can leverage our wide range of lenders and available products to ensure we secure the optimal solution.

Provincial Government Housing Affordability Task Force Report

On February 8, 2022 the Ontario government released a report completed by the Housing Affordability Task Force.

The Task force was comprised of industry leaders and experts who consulted with municipalities, advocacy groups, builders, planners, academics, industry associations, the public and more to identify and measure housing supply needs across Ontario and recommend an action plan to address any issues.

Their conclusion? “House prices in Ontario have almost tripled in the past 10 years, growing much faster than income…For too long, we have focused on solutions to “cool” the housing market. It is clear now that we do not have enough housing to meet the needs of Ontarians today, and we are not building enough housing to meet the needs of our growing population”.

“Ontario must build 1.5 Million homes over the next 10 years to address the supply shortage”. This is no small feat as it would require the current pace of housing supply to more than double (“In 2020, Ontario built about 75,000 housing units….since 2018, housing completions have grown every year…”)

To read the full PDF report please [Click Here] or click the read more button below access the Ontario Government’s Housing Task Force webpage.

Pricing & Demand Forecasts

TRREB overall average price growth from Jan 2021 to Jan 2022 was +28.6%, while Jan 2020 to Jan 2022 (2-year growth) was +48.2%. While this varies considerably based on property type and location (refer to various reports for details), in general these are jaw dropping results.

What’s drive the price growth? Limited supply and continued demand.

Where do things go from here? While no one has a crystal ball, we’ve pull together a list of “Tailwind” and “Headwind” items below that should shape the Toronto Real Estate market over the short, medium, and long term.

Tailwinds…

Numerous reports published recently indicate the need for more housing supply over the short, medium, and long term. If these supply issues are not addressed, increased demand through population growth and generational wealth transfer are likely to keep upward pressure on prices over the long term.

- Provincial Government’s Housing Affordability Task Force [click here for report] – Conclusion: “Ontario must build 1.5Million home over the next 10 years”. More than double the current pace of supply.

- Smart Prosperity Institute [click here for report] – Conclusion: Ontario will “require one million new homes” over the next 10 years.

- Canada’s population growth exceeds all G7 countries [click here for report].

- Canada’s number of homes per capita trails all G7 countries [click here for report].

- Densification – Toronto densification (population per km) trails most large cities [click here for report].

- Wealth Transfer – between 2016 and 2026, Canadians are expected to pass down over $1 Trillion in wealth [click her for report].

- Family Gifting – study concluded that approximately 30% of first-time homebuyers received a family gift to purchase their home. In Toronto, the average size gift was over $130,000 [click here for report].

Headwinds…

Even with sustained long-term upward pressure on prices, the market is always susceptible to periods of volatility. What could trigger a slow-down or pullback moving forward? Here are some of the items we have on our radar:

- Interest rate increases on the way – not if, but when.

- Government / Policy intervention. Possible areas we are watching as they were specific outlined in the Minister of Housing’s mandate letter [click here for report]:

- Temporary ban on foreign buyers

- Increased down payment on investment properties

- Ban on blind bidding

- Anti-flipping tax

- Reduced household savings as the economy opens up (more spending) and costs continue to increase as a result of inflation.

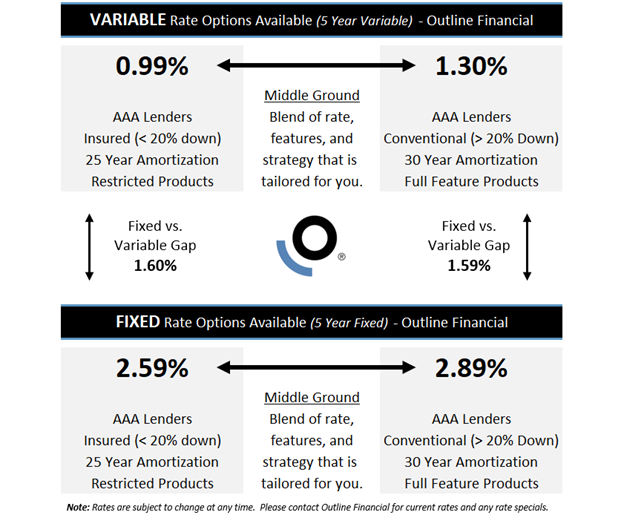

Mortgage Rates & Trends

Variable Rate forecast – as variable rates are linked to a lenders’/banks’ prime lending rate, any interest rate movement by the Bank of Canada typically results in an immediate change to variable rates. The Bank of Canada met on January 26th (no change in rates) and is scheduled to meet 7 more times this year:

Jan 26, 2022 (no increase)

Mar 2, 2022 (tbd)

Apr 13, 2022 (tbd)

Jun 1, 2022 (tbd)

Jul 13, 2022 (tbd)

Sep 7, 2022 (tbd)

Oct 26, 2022 (tbd)

Dec 7, 2022 (tbd)

In the January 26th meeting, the Bank of Canada once again left its overnight target rate unchanged at 0.25%, where it has been since March 2020. The next BofC meeting is scheduled for March 2, 2022 where we expect to see the first of many increases to come over the next two years.

As of the time of writing this article, the Big 6 Banks are generally forecasting four to five 0.25% increases in 2022 (starting in March with a 0.25% or 0.50% increase) and an additional two 0.25% increases in 2023 which would result in a total increase of between 1.50% to 1.75% by the end of 2023. We will continue to monitor these forecasts and update the information when applicable.

Fixed Rate Forecast – 5-year fixed rates typically follow the Government of Canada 5-year Bond Yields which is the market’s view/prediction of where interest rates will be in the future.

Bond yields have increased steadily since the start of 2022 moving from the 1.3% range to the 1.75% range where they currently sit (the highest point since March 2019). Fixed rates have also moved upward in lock step, and all eyes will be on the Bank of Canada during their upcoming March 2nd rate meeting.